lakewood co sales tax rate

The Ohio sales tax rate is currently. The December 2020 total local sales tax rate was 9900.

States With Highest And Lowest Sales Tax Rates

This is the total of state county and city sales tax rates.

. The Lakewood sales tax rate is. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. Get information on Accommodations Business Occupation Motor Vehicle and Property taxes in Lakewood.

Lakewood CA Sales Tax Rate The current total local sales tax rate in Lakewood CA is. The current total local sales tax rate in Lakewood WA is 10000. The California sales tax rate is currently.

Did South Dakota v. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. The PIF is not a City tax but rather a fee the developerproperty owner requires its tenants to collect.

Fountain CO Sales Tax Rate. What is the sales tax rate in Lakewood California. The minimum combined 2022 sales tax rate for Lakewood Washington is.

This is the total of state county and city sales tax rates. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. Lakewood CO 80226 MAIN.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. This is the total of state county and city sales tax rates. 6 rows The Lakewood Colorado sales tax is 750 consisting of 290 Colorado state sales.

Note that in some retail areas of the City a Public Improvement Fee PIF may be charged to reimburse the developer for on-site improvements. State of Colorado Sales Tax. A fee of 15 is required to.

Grand Junction CO Sales Tax Rate. The Colorado sales tax rate is currently. The Washington sales tax rate is currently.

Sales and Use Tax 2011 - Ordinance No. The December 2020 total. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Lakewood California is. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax. City of Lakewood Accommodations Tax.

The Lakewood sales tax rate is. The 8 sales tax rate in Lakewood consists of 575 Ohio state sales tax and 225 Cuyahoga County sales tax. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax.

The minimum combined 2022 sales tax rate for Lakewood Ohio is. Did South Dakota v. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. The December 2020 total local sales tax rate was also 6625. The maximum tax that can be owed is 525 dollars.

The County sales tax rate is. The Lakewood sales tax rate is. Lakewood collects a 34 local sales tax the maximum local sales tax allowed under Washington law Lakewood has a higher sales tax than 848 of Washingtons other cities and counties Lakewood Washington Sales Tax Exemptions.

The County sales tax rate is. The County sales tax rate is. Learn more about sales and use tax public improvement fees and find resources and publications.

Portions of Lakewood are part. 4 rows The current total local sales tax rate in Lakewood CO is 7500. There is no applicable city tax or special tax.

The County sales tax rate is. You can print a 1025 sales tax table here. The Lakewood sales tax rate is.

Return and payment due on or before January 20th each year. The minimum combined 2022 sales tax rate for Lakewood Ohio is. The Colorado sales tax rate is currently.

4 rows The current total local sales tax rate in Lakewood CO is 7500. City of Lakewood Sales Tax. Did South Dakota v.

Fountain CO Sales Tax Rate. This is the total of state county and city sales tax rates. There is no applicable city tax or special tax.

The Belmar Business areas tax rate is 1. Sales tax for Lakewood is 3. The minimum combined 2022 sales tax rate for Lakewood Colorado is.

The minimum combined 2022 sales tax rate for Lakewood Colorado is. What is the sales tax rate in Lakewood Washington. This is the total of state county and city sales tax rates.

Government entities and organizations holding a valid Lakewood Certificate of Exemption may purchase accommodations free of Lakewood sales and accommodations tax. The 1025 sales tax rate in Lakewood consists of 6 California state sales tax 025 Los Angeles County sales tax 075 Lakewood tax and 325 Special tax. Apply for permits licenses and registrations here.

License file and pay returns for your business. Lakewood CO 80226-3127 JM BULLION INC 11700 PRESTON RD 660153 DALLAS TX 75230-6112 Dear Taxpayer. Wayfair Inc affect Ohio.

How Amazon Charges Sales Tax On Colorado Purchases The Denver Post

Colorado Sales Tax Rates By City County 2022

How Colorado Taxes Work Auto Dealers Dealr Tax

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Why Do U S Sales Tax Rates Vary So Much

Ohio Sales Tax Guide For Businesses

Washington Sales Tax Guide For Businesses

Los Angeles County S Sales Tax Rate To Increase Measure M Will Take Effect July 1 The Citizen S Voice

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

States With Highest And Lowest Sales Tax Rates

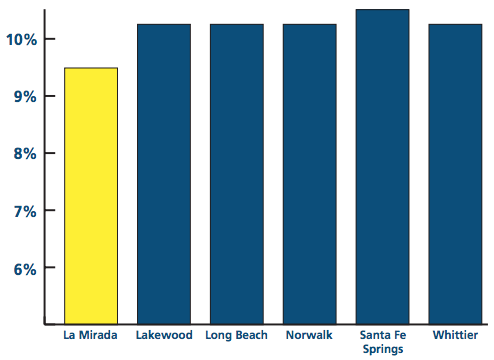

Local Sales Tax Rate Is Lowest In County La Mirada Chamber Of Commerce

2021 2022 Tax Information Euless Tx

Sales Use Tax City Of Lakewood

How Colorado Taxes Work Auto Dealers Dealr Tax

Mathematics For Work And Everyday Life

State And Local Sales Tax Rates 2013 Income Tax Map Property Tax

How Amazon Charges Sales Tax On Colorado Purchases The Denver Post